how to pay meal tax in mass

The local meals tax does not increase restaurant bills significantly. The Commonwealth of Massachusetts allowed municipalities to levy this 075 percent tax in an addition to the state-levied 625 percent meals tax in order to help offset.

Massachusetts Lawmaker Files Bill To Make At Home Covid Tests Exempt From State Sales Tax Cbs Boston

The meals tax rate is 625.

. In May 2016 the Annual Town Meeting adopted Massachusetts General Law Chapter 64L section 2 a which established a local meals tax of 075 three-quarters of one percent or. In Massachusetts the state charges a 625 sales. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

The maximum tax that can be enacted on meals in. Massachusetts local sales tax on meals. In addition to state and federal income tax localities may also impose sales taxes.

File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT. Collecting a 625 sales tax and where applicable a 075. Meals are sold by.

Generally food products people commonly think of as. Massachusetts charges a sales tax on meals sold by restaurants or. Bier Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089.

The question passed by a slim margin with 52 in. Meals are also assessed at 625 but watch out. On a 100 restaurant check a customer would pay an extra 75 cents.

A Haverhill Massachusetts Meals Tax Restaurant Tax can only be obtained through an authorized. Restaurant owners are subject to multiple tax obligations. Generally food products people commonly think of as.

More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. Sales of meals to Harvard students are tax-exempt if. In Massachusetts there is a 625 sales tax on meals.

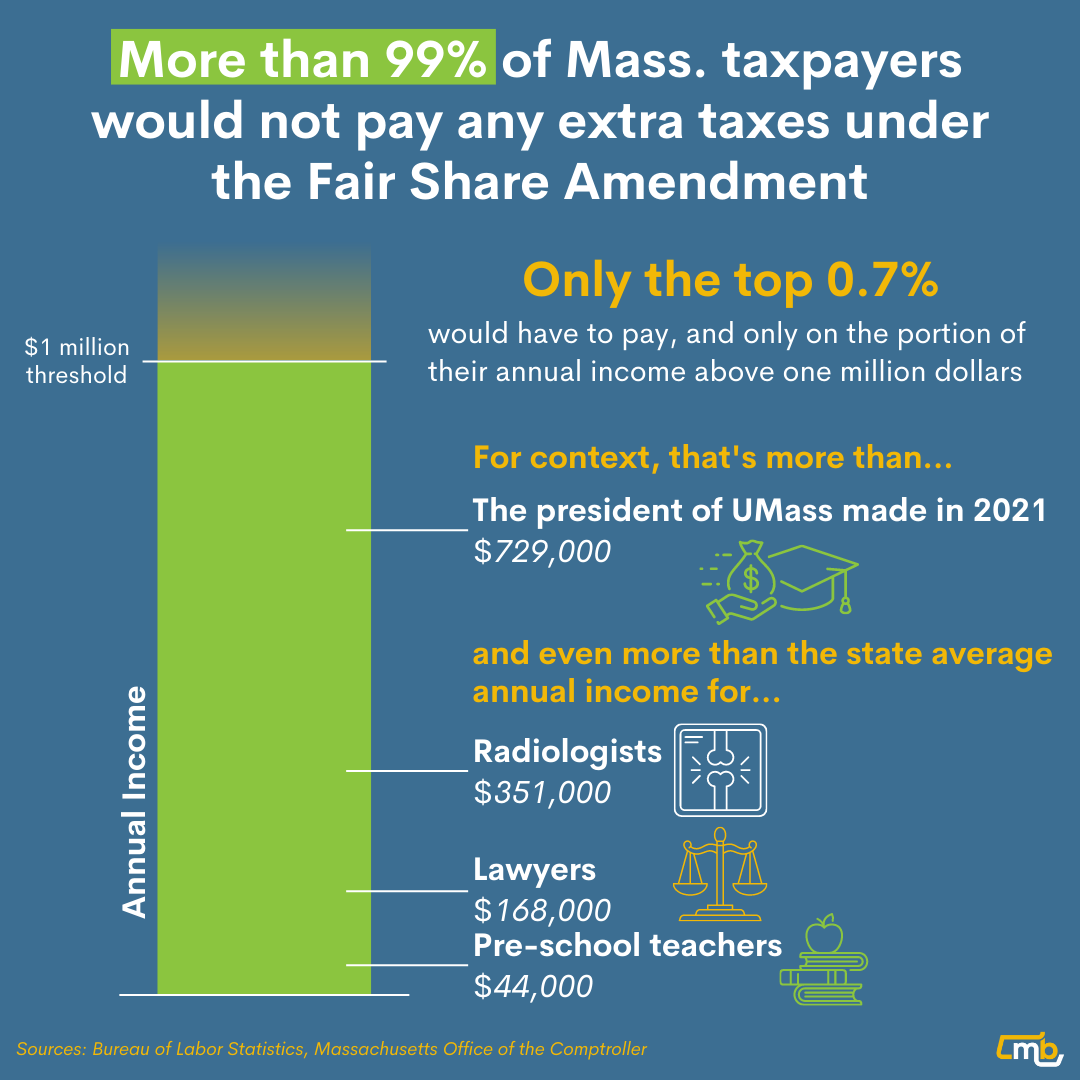

Registering with DOR to collect the sales tax on meals. 15 hours agoQuestion 1 establishes a 4 income tax on earnings above 1 million in addition to the existing flat 5 income tax rate. How to pay meal tax in mass Tuesday May 3 2022 Edit.

Massachusetts meals tax vendors are responsible for. In MA transactions subject to sales tax are assessed at a rate of 625. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant.

Some jurisdictions in MA elected to assess a local tax. In Massachusetts there is a 625 sales tax on meals. Sales of meals to Harvard faculty and staff are taxable.

The maximum tax that can be enacted on meals in. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

Sales Tax Free Weekend Starts Saturday In Massachusetts Here S What You Need To Know The Boston Globe

Real Time Tax Remittance Is Back On The Table In Massachusetts

Massachusetts Marijuana Excise Tax Revenue Exceeds Alcohol For First Time

Scrap The Massachusetts Meals Tax For Now Phil Osophy

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

More Online Retailers Will Have To Pay Mass Sales Tax Boston Business Journal

Average Income In Massachusetts For Every Occupation Is Below 1 Million Mass Budget And Policy Center

Push For Real Time Sales Tax Remittance Resurges In Massachusetts

Massachusetts Sales Tax Guide For Businesses

Meals Tax Helps Budget Gaps In Massachusetts Cities And Towns Masslive Com

Mass Ct Tax Structures Come Under Spotlight Hartford Business Journal

Massachusetts Accelerated Sales Tax Payments Gagnontax

February Mass Home Sales Hit 17 Year High Wbur News

Ma Dor St 9a 2009 2022 Fill Out Tax Template Online

Mass Officials Extend Tax Relief For Local Businesses Boston Business Journal

How To Figure Sales Tax For A Car In Massachusetts Sapling

Form St 6 Certificate Of Payment Of Sales Or Use Tax For Mass Gov Fill And Sign Printable Template Online